is there tax on louis vuitton | Do you pay taxes on LV items purchased in store in the USA? is there tax on louis vuitton One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on .

WARNING : TO REDUCE THE RISK OF FIRE OR ELECTRIC SHOCK, DO NOT EXPOSE THIS APPLIANCE TO RAIN OR MOISTURE. – This projector produces intense light from the projection lens. Do not stare directly into the lens as possible. Eye damage could result. Be especially careful that children do not stare directly into the beam.

0 · United States Announces French Handbag Tariff

1 · The US Won’t Tax French Luxury Goods by 25% After

2 · The Bag Lover’s Guide to Value Added Tax Refunds in the

3 · Louis Vuitton Duty Free Prices: A Comprehensive

4 · Louis Vuitton Duty Free Prices: A Comp

5 · Is There Tax On Louis Vuitton? Quick A

6 · How To Declare Your Hermès Purchases from Paris and Still

7 · How Can I Avoid Paying Taxes on Louis Vuitton?

8 · How Can I Avoid Paying Taxes on Loui

9 · Do you pay taxes on LV items purchased in store in the USA?

10 · Do You Have to Pay Tax on Louis Vuitton?

11 · Do You Have to Pay Tax on Louis Vuitto

12 · Buying in Vegas? : r/Louisvuitton

13 · A Guide to the Value Added Tax (VAT) Refund for

View and Download Canon LV-X2 brochure & specs online. SVGA & XGA models. LV-X2 projector pdf manual download. Also for: Lv-s3, Lv-5210, Lv-7210, Lv-7215, Lv-7555.

United States Announces French Handbag Tariff

Are you planning to buy a Louis Vuitton product but wondering if you can get tax-free benefits? The answer is YES, but it depends on where you’re purchasing the product from. Let’s dive into the details of tax-free shopping at Louis Vuitton.

The US Won’t Tax French Luxury Goods by 25% After

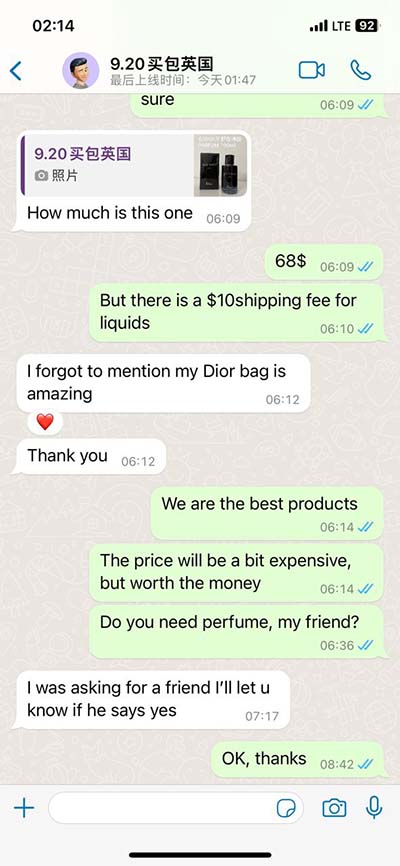

One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying . In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to .

Louis Vuitton lovers can breathe a (temporary) sigh of relief. The U.S. Trade Representative (USTR) is pressing pause on its plans to impose . Every traveler abroad is required to declare all their purchases made outside the U.S. When clearing Customs, an officer has the authority to impose a tax on all your . One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on .

I am planning to go down to Vegas later this year (hopefully) and the sales tax down there is something like 4.2%. Are the prices of the bags down in Vegas the same as everywhere? Do .

Tariffs are taxes paid by U.S. companies and passed along to U.S. consumer.” The ruling will directly affect French luxury behemoths LVMH, whose brands include Louis Vuitton, Christian Dior,. If you have an american passport you should be able to get a tax refund upon leaving london on purchases made in the EU, in which case I think you'd be given about 10% .

The Bag Lover’s Guide to Value Added Tax Refunds in the

Louis Vuitton Duty Free Prices: A Comprehensive

gucci blouse black and gold

Almost all luxury goods—including clothes, shoes, cosmetics and skincare, jewelry, handbags, leather goods, and art—will have a value-added tax. Many items qualify for a VAT refund, but it’s important to note that only new .

Are you planning to buy a Louis Vuitton product but wondering if you can get tax-free benefits? The answer is YES, but it depends on where you’re purchasing the product from. Let’s dive into the details of tax-free shopping at Louis Vuitton.

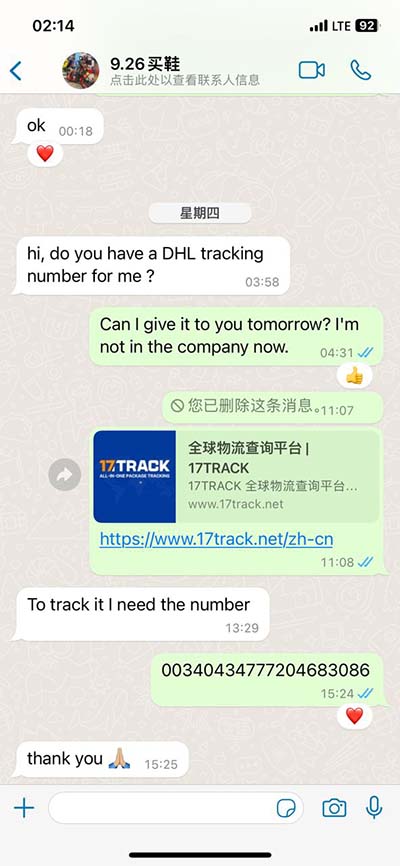

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury . At the Store: As long as you bring your passport with the appropriate visa, refunds are processed on the spot at a shop’s tax-free register (where you won’t pay the extra tax to begin with) or at a mall’s tax refund counter. Refunds can’t be requested at a later date; you must complete the process on the day of purchase.

Louis Vuitton lovers can breathe a (temporary) sigh of relief. The U.S. Trade Representative (USTR) is pressing pause on its plans to impose tariffs on French luxury goods. Every traveler abroad is required to declare all their purchases made outside the U.S. When clearing Customs, an officer has the authority to impose a tax on all your purchases. It could be as low as 3% or rise to 12% or more. In calculating the duty owed, there is an 0 exemption per person that is applied first.

One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers. I am planning to go down to Vegas later this year (hopefully) and the sales tax down there is something like 4.2%. Are the prices of the bags down in Vegas the same as everywhere? Do they mark the price up or anything like that? Tariffs are taxes paid by U.S. companies and passed along to U.S. consumer.” The ruling will directly affect French luxury behemoths LVMH, whose brands include Louis Vuitton, Christian Dior,.

If you have an american passport you should be able to get a tax refund upon leaving london on purchases made in the EU, in which case I think you'd be given about 10% "discount" on the merchadise if it's bought in the UK. In other european countries it's different. Almost all luxury goods—including clothes, shoes, cosmetics and skincare, jewelry, handbags, leather goods, and art—will have a value-added tax. Many items qualify for a VAT refund, but it’s important to note that only new goods (not used) can be claimed. Are you planning to buy a Louis Vuitton product but wondering if you can get tax-free benefits? The answer is YES, but it depends on where you’re purchasing the product from. Let’s dive into the details of tax-free shopping at Louis Vuitton.

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury . At the Store: As long as you bring your passport with the appropriate visa, refunds are processed on the spot at a shop’s tax-free register (where you won’t pay the extra tax to begin with) or at a mall’s tax refund counter. Refunds can’t be requested at a later date; you must complete the process on the day of purchase. Louis Vuitton lovers can breathe a (temporary) sigh of relief. The U.S. Trade Representative (USTR) is pressing pause on its plans to impose tariffs on French luxury goods.

Every traveler abroad is required to declare all their purchases made outside the U.S. When clearing Customs, an officer has the authority to impose a tax on all your purchases. It could be as low as 3% or rise to 12% or more. In calculating the duty owed, there is an 0 exemption per person that is applied first.

One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers.

I am planning to go down to Vegas later this year (hopefully) and the sales tax down there is something like 4.2%. Are the prices of the bags down in Vegas the same as everywhere? Do they mark the price up or anything like that? Tariffs are taxes paid by U.S. companies and passed along to U.S. consumer.” The ruling will directly affect French luxury behemoths LVMH, whose brands include Louis Vuitton, Christian Dior,.

If you have an american passport you should be able to get a tax refund upon leaving london on purchases made in the EU, in which case I think you'd be given about 10% "discount" on the merchadise if it's bought in the UK. In other european countries it's different.

Louis Vuitton Duty Free Prices: A Comp

Is There Tax On Louis Vuitton? Quick A

LV-HD420. The LV-HD420 offers Full HD resolution for projection of sharper and clearer images. This lightweight, compact model weighs 3.4kg and makes it easy to move from one location to another. The LV-HD420 also features enhanced vibrant colour reproduction at a much lower operating cost.

is there tax on louis vuitton|Do you pay taxes on LV items purchased in store in the USA?